Growth Markets Asset Allocation Trends: Evolving Landscape

By Fiona Dunsire

What happens as global economic leadership changes hands from the Western economy to the growth markets — countries in Asia, Latin America, Middle East and Africa? In our very first Growth Markets Asset Allocation Trends: Evolving Landscape, we analyze pension fund asset allocation in these dynamic markets and interpret what the trends mean for asset owners, asset managers and, ultimately, individual investors.

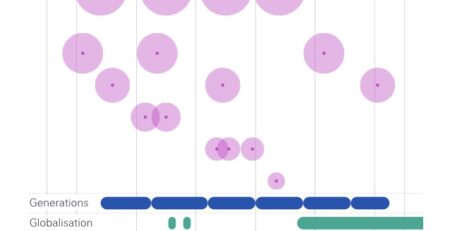

Consider these numbers:

25 of the top 50 global institutional investors are located in growth markets.

Almost 70% of global growth now comes from these economies.

In 2018, for the first time, more than 50% of the world’s population — 3.8 billion people — is considered middle class or rich; this segment is expected to grow to 5.3 billion people by 2030.

Fifty-four percent of the world’s middle class resides in Asia.

Growth market economies are quickly becoming leaders of global growth.

Their share of global equity market capitalization has tripled over the last 15 years to 30%, while their share of global market debt has doubled to around 20%. This trend will only increase as global financial markets catch up with their massive economic growth.

Read the complete book here!