Jamaica. National Insurance Fund reaches $143 billion

The National Insurance Fund (NIF), the source from which pensions and other benefits under the National Insurance Scheme (NIS) are paid, saw double-digit growth in the fiscal year ended March 2021.

In a new update provided by the Ministry of Labour and Social Security (MLSS), the Jamaica Observer learnt that as at March 31, 2022, the net asset value of the fund stood at $143.424 billion, representing year-over-year growth 14.13 per cent.

The NIF is funded by national insurance contributions, with asset growth driven mainly by the pension funds’ fixed income, loans and receivables portfolio.

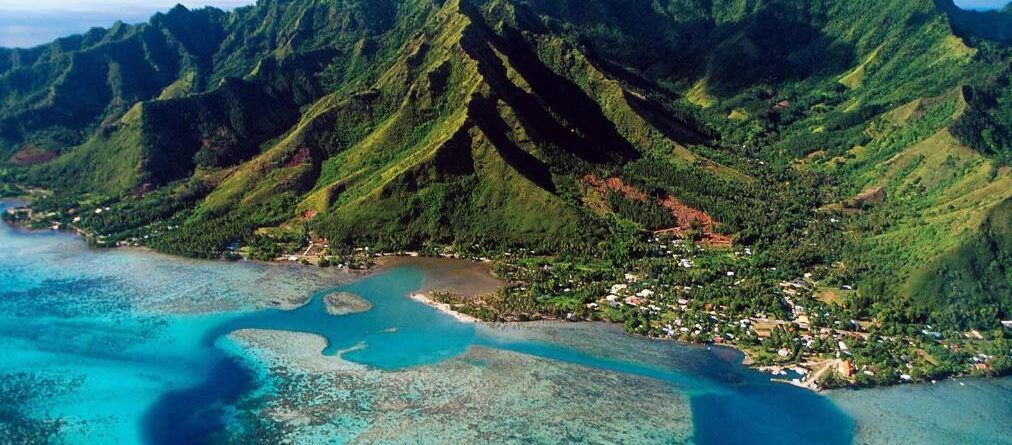

The MLSS updated meanwhile that there were no plans to sell any property over the next 12 months, which is a pull-back from an earlier indication in 2022 that it was considering the sale of resort Melia Braco and other properties.

Melia Braco is the NIF’s most valuable asset. Earlier this year the MLSS said it was in the process of “conducting an analysis of options for the best treatment of the property in keeping with the overall objectives of the fund. The results of the analysis could include a recommendation for divestment/sale.”

It had noted that the last valuation on Braco Resort Hotel (Trelawny) was US$48.3 million in 2020. El Greco Resorts (St James, also being considered for sale) was last valued at $1.3 billion in 2015.

Asked about the investment strategy being applied for fiscal 2022/2023 the MLSS replied that the focus was on, “Greater participation in the Global Equities Market and greater global diversification of portfolio assets.”

NIS collections (contributions) for 2021-2022 were reported at $29.813 billion (net of NHF allocations).

Meanwhile, total national insurance benefits paid out were $20.961 billion.

The MLSS commented: “As populations continue to age, social security spending increases to meet the needs of a larger number of persons who are living longer.”

It was noted that a “Newer and more robust organisational and governance structure for NIF is expected to be implemented as a result of the findings and recommendations of the NIF Review Commission appointed in 2018,” measures which are expected to impact sustainable fund growth.

Read More @Jamaicaobserver

198 views