US. CalPERS CIO Nicole Musicco says pension fund taking cautious approach to China

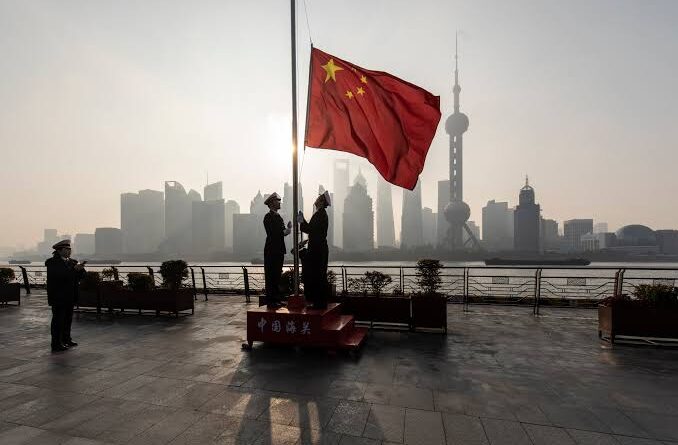

The California Public Employees’ Retirement System is being cautious in its approach to China because of the political blowback it could face for betting on a geopolitical rival of the U.S., according to Chief Investment Officer Nicole Musicco.

“We’re being mindful about our exposure in China right now,” Ms. Musicco said during an episode of “Bloomberg Wealth with David Rubenstein” — and she added that the pension fund giant is taking pains to “avoid having any big losses if we were to be told overnight to divest of China.”

There’s “always a risk” that lawmakers could direct the pension fund to cut its investments in China, where less than 3% of CalPERS’ portfolio is invested, Ms. Musicco said.

Her comments underscore the perils U.S. pension funds face when investing in the world’s second-biggest economy. The job of CIO at CalPERS often involves balancing competing pressures of politics and the task of maximizing returns.

Ms. Musicco joined Calpers in early 2022. Her challenge is to deliver steady returns for a pension system that cycled through leadership churn, strategy shifts and a retreat from private equity in the years following the 2008 financial crisis.

During the wide-ranging interview, the former private equity dealmaker also discussed the curse of being “woefully underweight” to venture capital and the fund’s interactions with managers.

The pension fund, with about $460 billion of assets, returned 5.8% in the fiscal year ended June 30, according to preliminary figures, short of its long-term annual target of 6.8%.

These are excerpts from the interview, which have been edited and condensed for clarity.

What is the investing style that you use at CalPERS?

It varies across the asset classes. Our fixed-income program is predominantly in-house. We don’t have fundamental portfolio managers, but some of the execution is done in-house on the public equity side. On the private market side, it’s generally all managers. Private equity, infrastructure, real estate — we’re partnering with general partners to invest on our behalf.

Are you worried about the future of venture capital as an asset class, or about the future of technology?

We’ve actually been woefully underweight, not only in private equity, but specifically in venture. So for CalPERS as a whole, from a portfolio perspective, I don’t have much to worry about because we’re so woefully underweight venture.

It’s been an interesting time. Every organization right now should be thinking very hard about AI in general, just how it’s going to impact their business, how it’s going to impact their customers, how it’s going to impact their own operations.

And so that’s one area within technology that we’ve been thinking through and being quite focused on, as well as climate tech. There’s a real opportunity to be thinking about how do you help the climate transition that’s about to unfold. There’s about $3 trillion of capital expenditure that’s required for all of us to hit our path to net-zero 2050 targets. That’s a tremendous amount of capital that needs to be deployed.

Are you worried about real estate in the U.S.? People aren’t coming to the office that much, and therefore the landlords are probably not going to have tenants renew the same amount of space that they once leased. What do you think about that concern?

The office space sector that you’re referring to is one that we’ve been really digging into to see what our exposure is. We’re very well-diversified across a number of different sectors within real estate. But certainly, within office buildings, if they’re not the Class A office buildings, there probably is going to be some real pain to be felt still as we’re starting to adjust to where interest rates are.

Do you get political pressure to not invest in China?

And the money you’ve already got there, are you going to try to take it out right away?

There’s a risk that, like the divestment bill that was suggested to be passed, where we’d have to divest immediately from fossil fuels of 200 names, there’s always a risk that we could get a similar action or a similar directive taken. So we’re being mindful about our exposure in China right now so that we can avoid having any big losses if we were to be told overnight to divest of China.