US. J.P. Morgan report estimates pandemic’s impact on unfunded retirement benefits

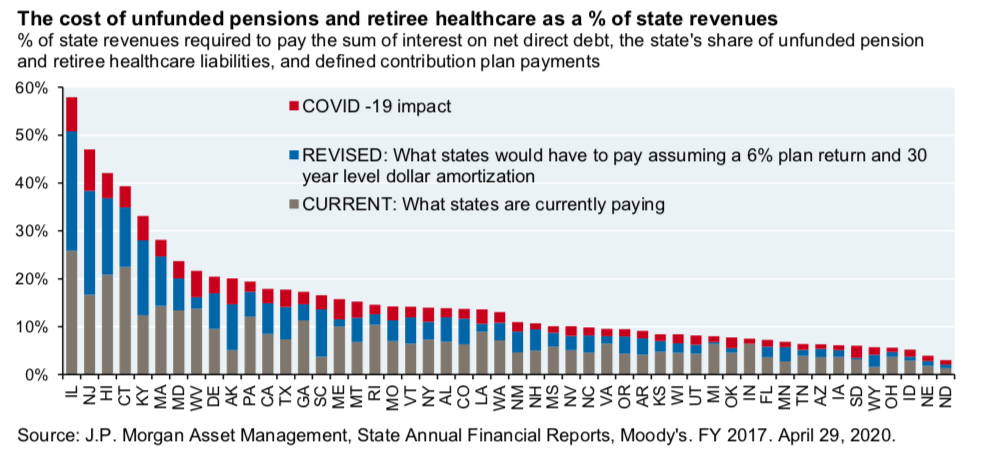

Banking giant J.P. Morgan issued a report estimating the impact of the COVID-19 pandemic and economic downturn on states’ unfunded pension and retiree healthcare liabilities, noting Connecticut would have to pay nearly 40 percent of its revenue for the next thirty years to pay off nearly $70 billion in unfunded liabilities.

Connecticut had the fourth highest cost to pay off its liabilities, with Hawaii, New Jersey and Illinois faring worse.

According to the report, the economic downturn added another 4 percent onto how much of Connecticut’s revenue would be needed to pay off its long-term retirement liabilities over 30 years, driving the percentage of revenue from 35 percent to 39 percent.

“Estimated COVID impacts were small for less indebted states, and larger for more highly indebted states, as you would expect,” wrote Michael Cemblast, Chairman of Market and Investment Strategy for J.P Morgan Asset Management and author of the report. “The first few bars on the left appear unsustainable from a long-term public policy perspective, but this was the case before COVID as well.”

Cemblast assumes a 10 percent “upfront valuation shock” in state portfolios and revenue declines between 13 and 15 percent.

The J.P. Morgan report estimated Connecticut spends roughly 22 percent of revenues to pay for pension and retirement healthcare costs. The estimate was based on state financial reports for 2017 compiled by Moody’s.

The Office of Policy and Management estimated General Fund revenue at $19.4 billion for fiscal year 2020, meaning the $3.2 billion in pension and healthcare retirement costs amounted to 16.6 percent of General Fund revenue.

Read more @Yankee Institute