2022 Natixis Global Retirement Index. Danger Zone. Global retirement security challenges come home to roost in 2022

By Natixis

When we introduced the Natixis Global Retirement Index in 2012, the world had just emerged from the global financial crisis: Memories of market turmoil were still fresh. Inflation was low, but so was growth. Central banks had slashed interest rates to all-time lows. Balance sheets had ballooned from asset repurchase programs. And public debt had swelled to record highs around the globe.

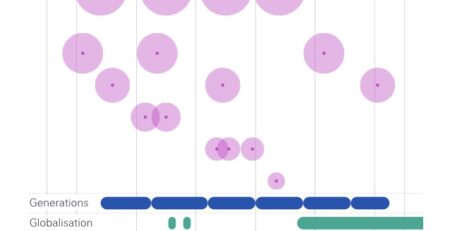

On top of it all, the first wave of the Baby Boom generation had just reached retirement age, indicating that pay-as-you-go retirement systems around the world would soon face a stress test like no other. It all raised the question of whether the models for those systems would be sustainable in the long term.

The time was right to examine retirement security from a global perspective. Working in collaboration with CoreData Research, Natixis Investment Managers sought to identify, measure, and track the key factors that would determine if individuals around the world would be able to live with dignity in the years after work.

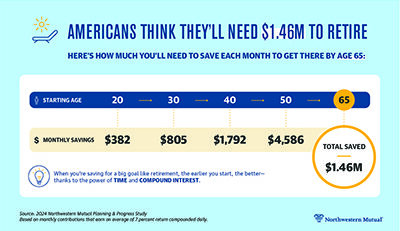

As an investment management company, we knew finances would factor greatly into retirement security. After all, the discussion often focuses on saving for retirement and generating an income in retirement. But we also recognized that like many sustainability issues, retirement security was a more complex, multi-dimensional topic. So the index went beyond interest rates, savings rates, and inflation.

People are living longer, and with age comes increased need for medical care. So the index considers health factors alongside finances. To ensure their finances hold up, the index considers key economic indicators that examine material wellbeing. And because retirees need to live in a clean, safe environment, the index considers quality of life.

In 2022, the world finds itself recovering from another global crisis. Inflation is running at levels not seen since the 1980s. Balance sheets and debt levels have soared even higher. Central bankers again are turning to interest rates as a stopgap, only this time they’re raising rates. After a decade-long bull run, the markets are more volatile, with indexes and investors around the world experiencing losses. The Boomer retirement wave is at its crest, and the Millennial generation is making its presence known in the workforce.

As the global economy evolves, the Natixis Global Retirement Index still meets its clear objective: to provide policy makers, employers and the public at large with a comparative tool for seeing where the factors are best aligned to ensure a secure retirement.

Get the book here