S&P 1500 Pension Funded Status Increased by 1 Percent in April

By Mercer

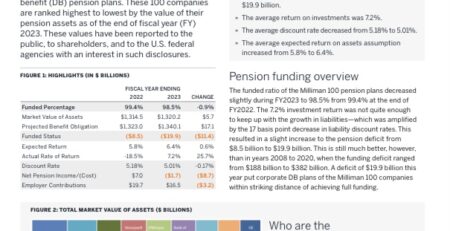

The estimated aggregate funding level of pension plans sponsored by S&P 1500 companies increased by 1 percent in April 2021 to 96 percent as a result of an increase in equity markets, slightly offset by the decrease in discount rates. As of April 30, 2021, the estimated aggregate deficit of $102 billion USD decreased by $16 billion USD as compared to $118 billion USD measured at the end of March according to Mercer,[1] a global consulting leader and a business of Marsh McLennan (NYSE: MMC).

The S&P 500 index increased 5.24 percent and the MSCI EAFE index increased 2.73 percent in April. Typical discount rates for pension plans as measured by the Mercer Yield Curve decreased from 3.01 percent to 2.89 percent.

“During April pension funded status rose to its highest level since the Great Recession thanks to strong equity markets,” said Matt McDaniel, a Partner in Mercer’s Wealth Business. “Equity markets, again, reached fresh all-time highs during the month but interest rates declined for the first month this year muting some of the gains. Equity markets have been relentless over the past year pushing pension funded status to levels not seen in over a decade but there’s always the looming risk of a pullback. In light of recent gains in funded status and the current market environment, plan sponsors should review their investment policies to ensure they have the appropriate balance of investment risk.”

Notes for editors

Information on the Mercer Yield Curve is available at http://www.mercer.com/pensiondiscount.

The Mercer US Pension Buyout Index may be accessed at http://www.mercer.us/our-thinking/mercer-us-pension-buyout-index.html.

Unless otherwise stated, the calculations are based on the Financial Accounting Standard (FAS) funding position and include analysis of the S&P 1500 companies.

Get the book here

182 views