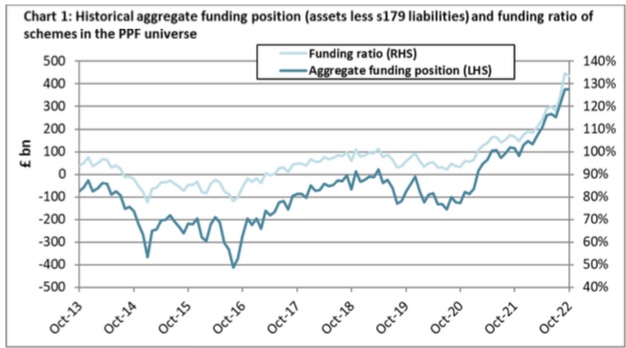

PPF 7800 Index

By Pension Protection Fund The PPF 7800 Index tracks the level of underfunding risk in the PPF-eligible universe using the latest scheme return information provided to The Pensions Regulator and the roll- forward methodology used for PPF levy purposes. There are certain simplifications within the levy calculation, as described in note 4 on page 7 of this document, that should be borne in mind when interpreting these results. In particular, the assets and liabilities have not been reduced for benefit...