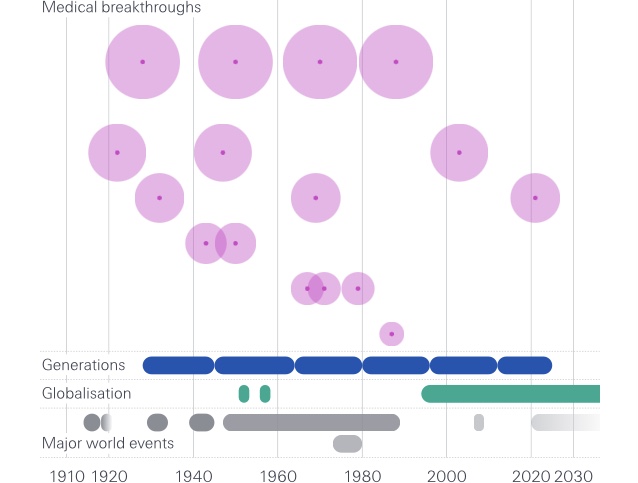

The future of life expectancy

By Prachi Patkee & Adam Strange Human longevity is one of the great success stories of the past century, and there is broad consensus that there are further gains to come. Mortality improvement forecasts underpin the insurance industry's long-term mortality and longevity lines of business. To generate long term forecasts, defined as beyond 20 years, a holistic view of the factors that influence mortality, which combine analyses of historic trends with a forward-looking view of medical advances, societal changes and...