2021 Corporate Pension Funding Study

By Zorast Wadia, Alan H. Perry, Charles J. Clark

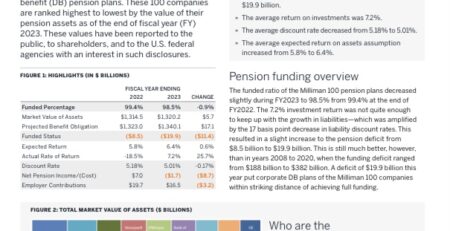

The 2021 edition of the Milliman Corporate Pension Funding Study (PFS) is our 21st annual analysis of the financial disclosures of the 100 U.S. public companies sponsoring the largest defined benefit (DB) pension plans. These 100 companies are ranked highest to lowest by the value of their pension assets that are reported to the public as of the end of fiscal year 2020, to shareholders, and to the U.S. federal agencies that have an interest in such disclosures.

A year prior, in our 2020 PFS, we began this report with, “Looking back to 2019 in April 2020 may seem irrelevant since we are dealing with the global pandemic’s horror and destruction to the health, jobs, businesses and financial assets of everyone.” As we open the 2021 PFS, we are even more aware of the magnitude of the destruction and efforts to overcome the human and financial toll from the pandemic. Recently, Congress passed and President Biden signed the American Rescue Plan Act of 2021 (ARPA-21). In doing so, the single-employer defined benefit plans that comprise our PFS were offered additional contribution relief that had begun with the Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020. This relief comes in the form of a reduction in the minimum required contributions by artificially increasing the discount rates for the actuarial calculations and allowing any pension deficit to be amortized over 15 years instead of seven years. It is unknown at this time how many of the Milliman 100 companies will elect to implement some of the early-adoption changes that would reduce their minimum required cash contributions

Get the book here

162 views