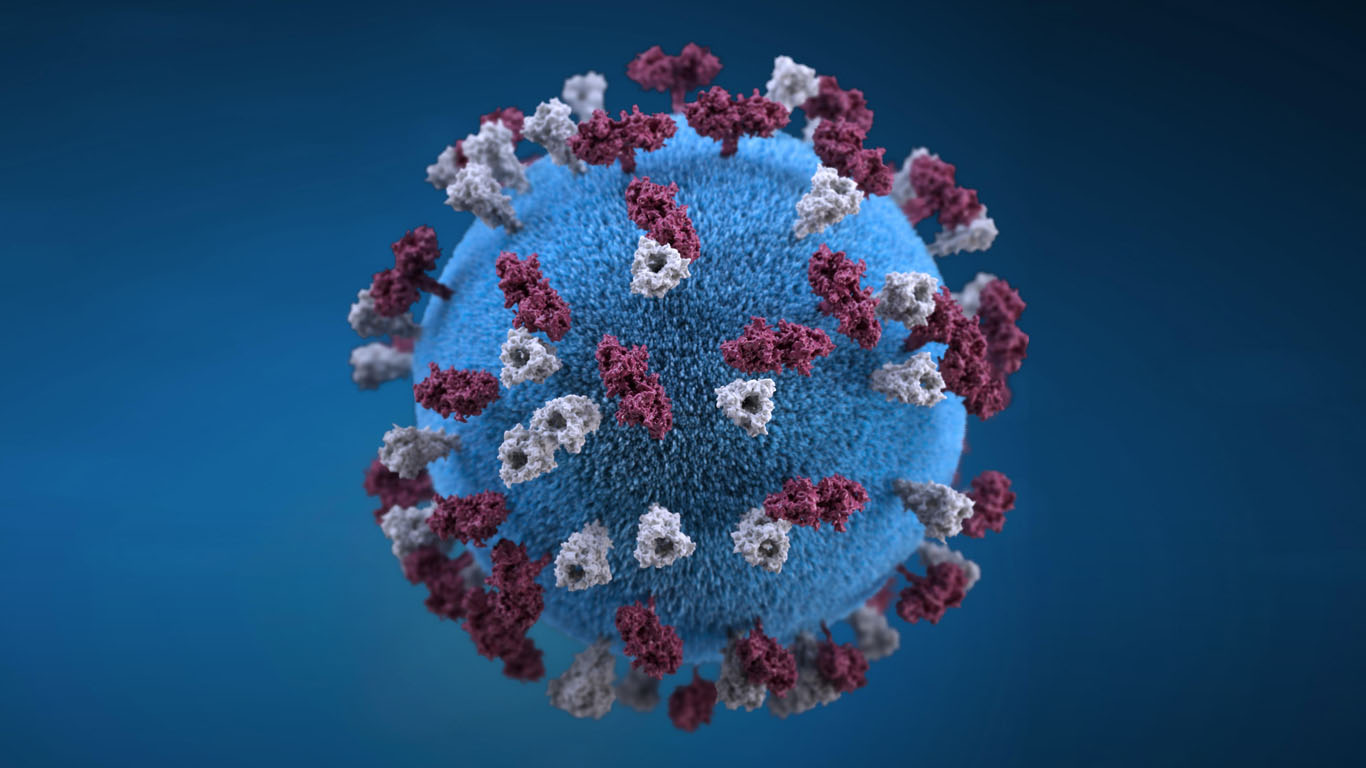

A New World Post COVID-19: Lessons for Business, the Finance Industry and Policy Makers

By Monica Billio, Simone Varotto Pandemics are disruptive events that have profound consequences for society and the economy. This volume aims to present an analysis of the economic impact of COVID-19 and its likely consequences for our future. This is achieved by drawing from the expertise of authors who specialize in a wide range of fields including fiscal and monetary policy, banking, financial markets, pensions and insurance, artificial intelligence and big data, climate change, labor market, travel, tourism and...