Ireland. The Two Main Reasons People Don’t Have A Pension

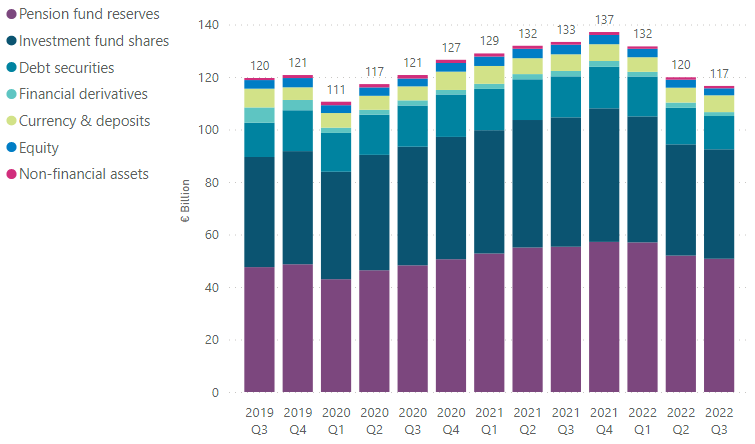

More than two-thirds of workers have some form of pension coverage outside of the State pension, the Central Statistics Office (CSO) has said. Of the 68% of workers aged 20-69 with additional pension coverage, 70% have an occupational pension, 10% have a personal pension and 20% have both, including 22% of men and 19% of women. For employees with occupational pensions from their current employment, the number with 'defined benefit' pensions decreased in 2023 from 32% to 30% while the number with 'defined...