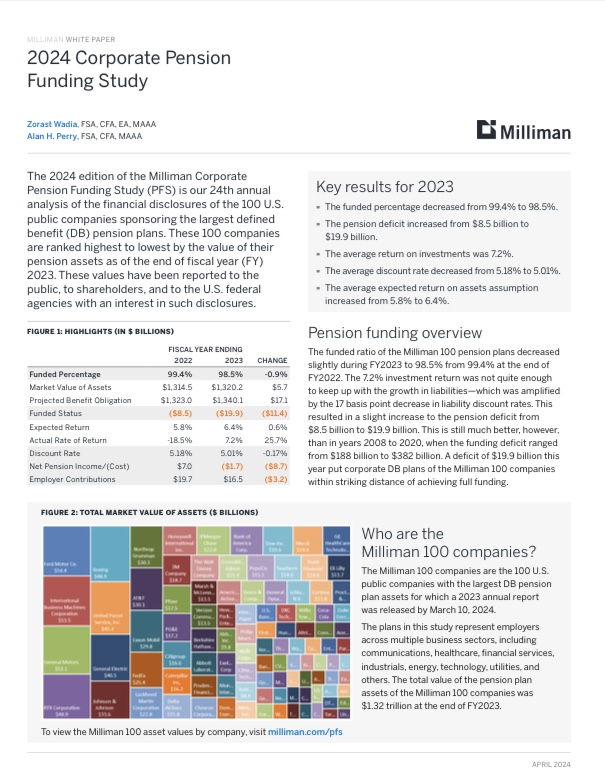

2024 Corporate Pension Funding Study

By Zorast Wadia & Alan Perry The 2024 edition of the Milliman Corporate Pension Funding Study (PFS) is our 24th annual analysis of the financial disclosures of the 100 U.S. public companies sponsoring the largest defined benefit (DB) pension plans. These 100 companies are ranked highest to lowest by the value of their pension assets as of the end of fiscal year (FY) 2023. These values have been reported to the public, to shareholders, and to the U.S. federal agencies...